Last Updated on October 9, 2025

The global economy is facing a “perfect storm” of fiscal pressures, political instability, and monetary easing. And once again, gold has emerged as the clear winner, with prices breaking above $4,000 per ounce in 2025 — a historic gold price record.

But can gold truly outshine the U.S. dollar as the world’s safe haven?

Why Gold Is Rising in 2025

Several factors are fueling the rally:

- U.S. Dollar Weakness – Shifts in U.S. policies at home and abroad, combined with the possibility of interest rate cuts by the Federal Reserve, have weakened the dollar. Many investors are pulling money out of the greenback and reallocating to gold.

- Geopolitical Instability – Political turbulence in France (with the resignation of Prime Minister Sébastien Lecornu) and uncertainty in Japan (with Sanae Takaichi expected to take office) have pushed global investors toward safer assets.

- Global Demand – Central banks, especially China’s, have been buying gold for 11 consecutive months. Exchange-traded funds (ETFs) tied to gold have also seen inflows.

- Commodities Repricing – In Australia, gold has overtaken liquefied natural gas as the country’s second most valuable export, with revenues projected to hit A$60 billion ($39.6 billion USD) in 2025–2026.

Gold vs. Dollar: Which Is the Better Safe Haven?

Some high-profile investors, like Ken Griffin of Citadel, have voiced concern about the growing perception of gold as safer than the dollar. He calls the shift “worrying,” pointing to America’s reliance on fiscal stimulus and monetary easing, which he likens to a “sugar high.”

For decades, the dollar has been the world’s primary safe-haven asset. However, in 2025, investors are increasingly questioning whether the greenback can maintain that role in the face of high debt, inflation risks, and political gridlock.

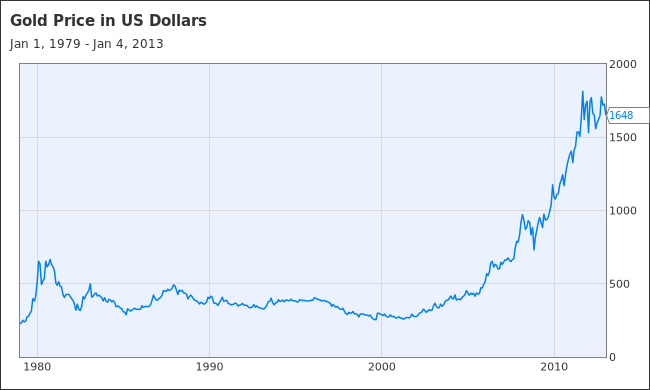

Gold price vs US Dollars – 1979 – 2013:

The above graph shows the price of gold against the US dollar. The gold price rose to above 500 dollars in the beginning of the 1980s because of the high inflation, geopolitical instability and the 1979 oil crisis, then the price dropped and didn’t recover to the same levels until the great financial crisis of 2008.

Other Assets in the Rally: Silver and Bitcoin

Gold is not the only asset on the move:

- Silver – Riding the wave of safe-haven demand and industrial use, silver prices are also expected to reach new records.

- Bitcoin – While volatile, Bitcoin is attracting inflows as some investors treat it as “digital gold.”

For a diversified portfolio, combining traditional safe havens like gold with alternative assets could help balance risk.

Australia’s Gold Boom

Australia is a top global producer of gold and is set to increase production from 340 tons in 2025–2026 to 369 tons the following year. This production boom, alongside gold price records, will help offset declines in other commodities like iron ore.

For global investors, this signals strong opportunities in gold-mining stocks and ETFs with exposure to Australia’s mining sector.

What This Means for Personal Finance Investors

- Gold as a Hedge – Rising uncertainty makes gold an effective hedge against inflation, currency devaluation, and geopolitical risk.

- Diversification – Don’t abandon the dollar, but diversify into gold, silver, and even digital assets.

- Watch Central Banks – Their ongoing purchases are a key driver of gold demand.

- Consider Mining Stocks & ETFs – Exposure to miners, especially in Australia, can provide leveraged upside when gold rallies.

- Think Long-Term – Gold may correct in the short term, but in times of fiscal and political strain, it remains a store of value.

Bottom Line

The gold price record in 2025 is a reminder of how quickly global conditions can shift investor confidence. While the U.S. dollar still holds reserve-currency status, the surge in gold demand underscores the need for diversification in uncertain times.

For investors, the message is clear: gold remains the ultimate crisis asset. The difference here is that there is not an immediate crisis with the stock market prices or with the big economies. Normally gold rallies when the stock market is going down, so we have a unique situation here.

We at Invest Education believe that this is a short term effect. The dollar is going nowhere in the future even if Donald Trump’s policies become stranger than now. The US will continue to be the biggest powerhouse and the gold will continue to be a way to diversify in times of crisis. Decades of history can’t be wiped out without a major financial system change which we don’t have at the moment.

We think that once the war in Ukraine is over, Donald Trump’s financial measures are calmed down and the world financial system is stable, the price of the gold will drop to more reasonable levels and will experience the same behavior patterns as before – safe heaven in crises and an asset to help against inflation.

FAQs: Gold Price Record 2025

Q1: Why did gold break above $4,000 in 2025?

A: Dollar weakness, U.S. monetary easing, political instability in Europe and Japan, and central bank buying all pushed gold to record highs.

Q2: Is gold safer than the U.S. dollar?

A: Gold is a strong hedge, but some experts caution that the dollar remains essential as the world’s reserve currency. The safest approach is diversification.

Q3: Are other safe-haven assets also rising?

A: Yes. Silver and Bitcoin are both experiencing rallies as investors look for alternatives.

Q4: What role is Australia playing in the gold price record in 2025?

A: Australia has become the second-largest exporter of gold by value, projecting A$60 billion in revenue for 2025–2026, with rising production.

Q5: Should I invest in gold now?

A: Gold can be a useful portfolio hedge, but investors should balance allocations with stocks, bonds, and other assets to manage risk. At the moment the price seems too high, so invest only after you do your own research.

Featured Image by Steve Bidmead from Pixabay

Disclaimer: This content is for informational and educational purposes only and does not constitute financial or investment advice. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.